In this article, I want to break down one of the most important problems in retrodrops – the effective distribution of your finances. Communicating with different people, I often see how people go all-in to one project, create a million “homeless” people and only a couple of main accounts, invest everything in drops and do not leave any free liquidity for “life” in the crypt.

This is my personal vision and understanding of what is happening. I will try to explain it in as simple terms as possible. There will be those who categorically disagree with me, and there will also be those who will listen and in the long term, financially, will leave behind these categorically disagreers.

Who is this article for?

For everyone who is not afraid to educate themselves and is ready to immerse themselves in the world of proper finance. Without exaggeration, I can say that this article will change your financial life for the better. I advise you to read it several times and think about every word.

1. Stable source of income

First and most important. A little tediousness and then let’s return to the crypt. Dreaming about X’s for a briefcase and successful retro cases, we forget a simple truth: there must be a business that consistently feeds you, and there must also be a safety net in the form of savings that you under no circumstances spend. You can’t go anywhere without these two things. Not at all. Life is such a thing that today you see prospects and a green light at every traffic light, and tomorrow, God forbid, a black swan happens in your life. It could be an illness, injury, divorce, a car hit, an apartment flooded, and much more. If you invest every penny in crypto, abandon your job/business and trust chance, then in most cases you will find yourself up to your ears in loans with dull, depressed eyes. This has been recorded, let’s move on.

2. Portfolio distribution in crypto

Crypto itself is one of the riskiest financial instruments. And retro is a risk squared. We were inspired by successful cases like Arbitrum that you can make crazy X’s for any size. You can invest all your money in retro and you will only get richer. Stop and think, why were we given such cases? Was it beneficial for them? How are the funds connected to each other and why did they distribute so much money and then there was such a long pause? The thinking minority will have many more doubts and questions than simple and quick answers.

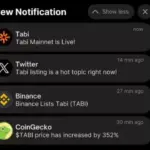

Let’s remember the cases that happened to us recently :-

- StarkNet has shaved off a lot of people. It had to be started already in September, and on the balances it was necessary to have 0.005 eth. The criteria seem to be simple, but the majority shaved off. Unity residents just received their cherished life change.

- MEME delayed the distribution for almost six months; in the end, it awarded only to the main accounts, and the vast majority of farms went into the red. I have practically never met people who were happy with the award.

- Multi-account with staking ATOM, OSMO, TIA, etc. requires more and more investments, and rewards those who have been with him for a very, very long time.

And more and more such cases appear. I believe that the retrodrop market will not get any easier, and every day you need to increase your professionalism, invest more money and effort. Perhaps we are already witnessing the culmination of the retrodrop cycle.

How can you protect yourself at least a little in the market?

A simple and effective way is diversification. We’ve all heard that you can’t put your eggs in one basket, but only a few actually follow this.

This is just an approximate distribution of finances within a crypto portfolio. Everyone chooses a share themselves, based on their risk management. But I do not recommend reducing the share of investments below 30%. And ideally, bring it up to 60%.

If you’re into retro, your portfolio should look something like this :-

- Investment portfolio

- Portfolio for speculation

- Money invested in retrodrops

Let’s figure out why this is needed and how to work with it.

2.1. Investments

Introductory information :-

Investments are the least dangerous form of interaction with the market listed above. The advantage of investments over other financial instruments is the ability to reduce the number of points where you can make a mistake. And mistakes, in turn, are often made due to the basic human vices: fear and greed. With the right approach to investing, you partially exclude yourself from the process and stop interfering with your own assets.

In the case when we actively speculate and engage in retro activities, it is important for investments to play a key role – to insure the event of defeat in our favorite activities. This is a kind of risk hedging. In any case, we will lose somewhere and earn money somewhere, but there must be at least 1 tool that we trust. If it happens that most of the money is lost on retros and speculation, then we will have an emergency reserve in the form of a portfolio of assets, which, on a bull run, will give us the last chance in this cycle.

Important: Do not confuse investment and speculation

Investment means buying a portfolio of different assets and forgetting about it until the end of the bull run. Speculation is bought, sold, poured, got into the hype, changed your mind, etc. If you think that you will achieve more through speculation than through classical investing, then you will very quickly be run over by a 40-ton market roller. For this, we have a speculative portfolio, we will learn from it and mediocrely destroy it.

Market stages :-

To start investing, you need to understand at least a top-level understanding of how the market works.

- Launch of the project to the market – The project begins to draw its history, while not much attention is focused on it, the market maker has not yet carried out large volumes on the exchanges. This all happens quite quietly. Basically at this stage the coins are held by the community, defi and buyers from the market. But investors either don’t have coins yet, or they don’t plan to sell them.

- Trading, selection of coins – Start of release. The main part is already with the market maker. What was distributed in the form of an airdrop, bought from the market at the first stage, they try to take away due to the rise and fall of asset prices. As a result, only a few investors remain who stayed in the position from the first stage. Thus, most of the coin issue is already with the manipulator.

- Growth, distribution – The information field is connected, everyone already knows about this asset. Everyone is talking about the coin: celebrities, the media, bloggers, successful projects related to the coin are being launched. At this stage, the manipulator is already selling, and the crowd is buying.

- Sale – Stage of discounts on the asset. After people have already seen the all time high, they perceive the lower price as a very good discount and the last chance to buy. And the market maker carries out the second stage of selling coins.

- Dump, surrender, accumulation – This is usually the longest stage of all. After the culmination and distribution of coins to the crowd in stages 3 and 4, the market maker needs to collect the coins back from people to repeat all the manipulations again. There is a long period of trading, the purpose of which is to make people lose faith and sell the asset at a loss. The information field adds negative news. A person who bought $1000 now sees $30-50 in his account. And this can continue for a very long time: a year, a year and a half, until all the remains are collected from the market.

- Cyclicality – At the fifth stage, the market maker makes the final decision about whether they still need this asset and whether they will repeat all stages on it again. Here, assets released in the new cycle look most profitable. Since we are more likely to be able to participate in all stages.

Fundamental rules of investing :-

- Invest only your own funds – This is the first and most important rule. No loans, borrowed funds, debts from friends and relatives. Anything can happen in the market. Let’s remember this.

- Invest only at the accumulation or exit stage of the project – Looking for the bottom of the market is a thankless task. We will never be able to accurately predict the ideal price to enter an asset; we can only get a little closer to it. If a project you are interested in comes out, you can try to evaluate the price on the listing to see if it suits you. If not, then we simply leave the project and humbly wait for the accumulation phase so that we can enter there.

- Withdraw invested funds – When an asset/portfolio already has a significant profit (from 2 x or more), you can gradually fix the body, this will help you protect yourself. After the moment of complete fixation of the invested funds, the market will no longer be able to defeat you. It is important to do this only after the asset has left the accumulation zone. And it is advisable to withdraw this money completely from crypto. A good option would be not to record everything at once, but to do it gradually, spreading it out over several weeks or months. The parts that have grown the most. It will be much easier for you to keep such a portfolio.

- Do not purchase additional assets – When assets grow, it is tempting to buy a little more to earn more. This cannot be done. Thus, you break your entry points, break your investment logic. That is, if you bought an asset at $1, after which the asset rose to $10, your entry point will move much higher. And any correction can drive your portfolio into negative territory. You can lose that very “invulnerability” in the market and easily go into the red. It is important for yourself to understand that you still will not earn all the money in the world and you should not treat this as your last opportunity. If you can get through one cycle, perhaps earning a little less, then in the next cycle you will have a chance to do everything much better. The market is open, the market will work, you will have many, many more chances.

- Information field values – The information field cannot in any way be the reason for buying or selling. This is not a trigger for action, it is a tool for informing about what is happening in the market now. The information field allows us to calculate the “hospital temperature”, understand where the crowd is looking, what percentage of people are in the market and what movements they expect on the chart. If you act in the market based on the information field, then do it in the opposite way.

- Diversification – The portfolio must consist of at least 10 assets. There are not so many really good assets on the market. It will be difficult for you to find even 100 adequate assets, because there simply is no such quantity. In reality, there are at most a couple dozen good projects and as many more promising ones.

- Analyze assets yourself – This is probably the most difficult point for a beginner. Most often, when searching for information about a project, you will come across advertisements.

- “The Wealth Principle” – Rich people get richer and poor people get poorer. The same principle can be transferred to projects. Good and expensive projects will continue to develop and become more expensive, while low-quality and cheap ones in most cases will remain so. For example, Arbitrum and Optimism will rise in price, and projects ranked 1000+ in CoinMarketCup will most likely never rise higher.

- Sale of coins – If you have done the step of purchasing and withdrawing invested funds correctly, then you only have the last step – selling your assets. Growth cannot continue forever; here you need to control your greed and take profits. It is necessary to fix profits at the distribution stage. Sometimes completely, sometimes in parts as they grow. But in any case, you have to sell. Otherwise, why did you buy if you are not going to sell? In general, this will be the most important battle with yourself and your own greed. I hope you come out victorious.

- Don’t fall in love with projects – Under no circumstances should you become a fan of your assets; you must treat them coldly and judiciously. If you still believe madly in the project, you will get 90% out of it and feel the money. Believe me, you are unlikely to want to return them back. And 10% can be left to test your faith.

- Set goals not for the asset price, but for the market stage. – We are not professional traders, there is no point for us to play guessing games and count future X’s. The goal of the portfolio is to buy at the accumulation or exit stage of the project, wait for the bull market and exit it at the distribution stage.

Summary :- The most important thing in investing is to conquer your vices: fear and greed. Analyzes, investors, raw numbers and business metrics are just a small part of the iceberg that is above the water. And where most of it is hidden under water is psychology.

2.2. Retrodrops

Here, each of us considers himself an expert, knows in advance what the criteria will be and believes that he will defeat this industry. But in fact we don’t know anything. And we can only play with probabilities and expectation. Let’s now break down the finances in the drops. There are two options and each has its own approach :

- You have a certain amount for drops and you don’t plan to allocate more in the coming months. It is important to understand that you cannot spend everything at once. It is necessary to distribute this amount over at least 3 months, and even better over six months. Since new projects may appear on the radar, in which you would definitely like to invest, but there will be no more money. Also, do not forget that it is necessary to maintain the frequency of accounts and you cannot drive yourself into a position where there is nothing to activate for the next month.

- You have cash flow that you are ready to invest in retro every week/month. Everything is simpler here; we distribute this amount to current projects proportionally. And we build a strategy based on a predetermined amount.

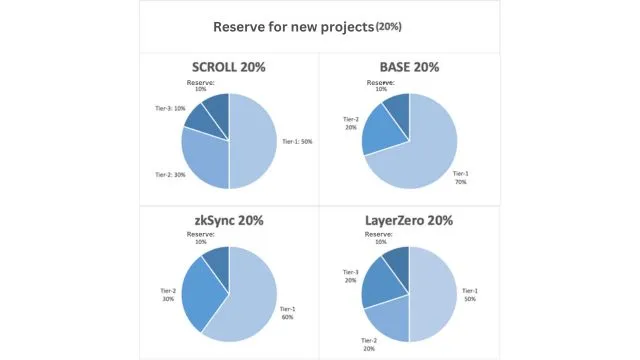

The infographic above describes the strategy for investing in retro. Let’s break it down point by point :-

- Diversification – It’s similar to investment. You cannot single out one project and pour a lot of money into it – this overestimates your risks. As, in fact, many did with LayerZero, let’s put our entire bank on this horse. You need to select, for example, 4 projects and distribute the budget evenly.

- First the budget, then the accounts – We first need to determine what budget we can allocate for the project, calculate the costs of accounts of different shooting ranges, and only then churn out cartoons, and not vice versa. Otherwise, at some point you will realize that you simply cannot afford such a large farm financially.

- Diversification within the project – It is important to divide accounts into different tiers. And do the next tier only after you have completely closed the previous one and you only have months left to fill.

- Determine in advance how many maximum projects you can handle – Spraying yourself on many tasks is not always good. You will do everything, but you will do it poorly. It is better to highlight 4-5 projects, distribute funds between them, but do them perfectly.

- Reserve money for the project – Be sure to leave at least 10% of the allocated money for the project. It is advisable to store this reserve in stables or in the main coin of the project. This should definitely be done in case you need additional resources for branding or if the project introduces some kind of mandatory activity.

- Reserve money for retro – Here it is advisable to leave enough money to be enough for 1-2 more projects. This may be a common box with the previous point. But the point here is also simple: if you are interested in a new project, then you will need money that you can allocate. This money can also be used to increase volumes in projects.

- Tier-1 accounts – I would recommend spending more than half of the budget allocated for the project on such accounts. You simply must have accounts that you think will 100% pass. Absolutely every possible criterion that can come to your mind should be made on them. Even if you think that this is nonsense and the project will definitely not shave. These accounts will be your gold reserve. Do it with multipliers in mind, not minimum criteria. In the case of a hard razor, they will save your capital and allow you to earn money.

- Tier-2 accounts – I would spend at least half of my remaining budget on such accounts. We create this group when we already have completely ready Tier-1 accounts. We will adjust them to the minimum criteria. There is no longer any need to create official bridges, ens domains and other similar things on them. The goal here is to achieve quality as economically as possible.

- Tier-3 accounts – This is a unique case, I wouldn’t go so deep after watching how current projects began to be shaved. This is up to everyone to decide and greatly depends on the project. I would recommend making such accounts in case you have free liquidity and want to add it to your current project.

Let’s look at the example from the picture at the beginning of the section, let’s say we have $10k for retrodrops. We immediately set aside $2,000 as a reserve. Next, we divide this money into 4 projects in equal shares of $2000 each. First, we create Tier-1 accounts in each project; there should be more than half of them. The number of these accounts is determined by your inner feelings. It could be 50%, 70% or even 100%. And then we distribute finances to lower levels.

2.3. Speculative Portfolio

This is the smallest of our portfolios. It is needed for momentary “topics”, private chats, courses, futures, shields, allocation of liquidity for some new activities, purchases of NFTs, new narratives, etc. In general, everything that is neither retro nor investment. With him we do whatever we want. We learn from it, gain experience, take risks. In a word – we are speculating. This portfolio will give us the strength not to take money from the retro and investment portfolio. Stand strong on your feet, and also don’t miss out on the “Stopudovye Temok” in the market.

Why should there be a speculative portfolio?

It is like a safety net for you, since at any moment a situation may arise in the market when you need to go to the pre-sale, buy off the bottom, participate in a potential project, etc. But if all the money is in positions, then you may miss out on GEM.

Now you need to analyze the manipulations that you want to perform: whether it’s buying shieldcoins, NFTs, working off savings (spoiler: we’ll talk about it in the bonus section of the article) or futures.

Let’s look at each of these options :-

- Futures – This is one of the most difficult types of trading, which can make you a super rich person for 1 day, or reset your entire deposit. Without a wealth of knowledge and fairly advanced discipline, don’t even bother coming here. I can show you dozens of examples of how guys were liquidated for 1,000, 5,000 and even 10,000 dollars in one day and then they took a very long time to come to their senses. Although there is a golden rule in futures – put a stop, but greed and fear can lead you to the monastery. Would you like to try this type of trading? There is a pretty healthy solution: transfer 10-20 dollars to your trading account and try trading for a month. You will see how easily this money can disappear! Just as easily $10 was gone, your $10,000 could have gone just as easily.

- Working off savings – Everything is much simpler and calmer here. Here you can simply buy on spot and wait for the coin to fly. If you have $1000 allocated for all these games with savings, then a position of 5-20% may be justified. Not 100%, remember this !

- Shieldcoins – I’ll say right away that almost 100% of all coins that are just coming out are scams. Therefore, careful analysis is necessary before purchasing. This is an incredibly risky activity, so I advise you to enter into a trade for 1-5% of the deposit, no more. You will either turn the sum into 0 or it will be big X’s. The first happens much more often. I would also like to note that all these memcoins, which account for the current growth, which we already know and can buy on serious exchanges, came out of the shields. This is nothing more than a survivor’s mistake. Hundreds and thousands of shields that were launched during the same period of time will remain behind the scenes.If you still want to get into shieldcoins, then I will give you a couple of tips on what to pay your attention to :-

- Liquidity – As a rule, there should be a tidy sum (not 2-3k dollars)

- Liquidity blocking status (Rug pull) – If there is no liquidity lock, then the creator of the coin can withdraw the entire pool at any second and you will be left with 0.

- Buying and selling commissions – It is important here that it is less than 5-10%. There are coins where the commissions are incredibly high. This is a sign of an obvious scam.

- Opportunity to sell (Honeypot) – Sometimes scammers block this opportunity. You will only be able to buy a coin, but you will not be able to sell it. This is one of the most common types of deception.

- Top holders – If a large percentage of the token emission is in the same hands, then the hour is not far off when all this emission will fly completely into the glass and reduce the price of the shield to almost zero.

- In the end we look at social networks and the project website. Does it exist, how is it designed, how many subscribers are there, how active are they, how often do they share the project on social networks, what are the plans for the project.

All these points can be checked on the following dex: dexview , dextool , birdeye and dexscreener . There is also a telegram bot where you can insert a contract and see all the information you are interested in: @HoneypotIsBot. A very convenient thing for a quick check.

- NFT sphere – This area is now beginning to revive. And the easiest way to enter it is to purchase NFT from Tier-1, Tier-2 projects. For example, Pandra King from the Polyhedra project. I bought them for $20, and in the end they went up to $250. At their peak, their price was $400+. This is justified by the fact that Polyhedra is a top project, it was made by hundreds of thousands of retrohunters, NFT has a limited supply and has utilities. Based on this, there is a little advice for you: if you are hunting for a retrodrop from a project and it releases its own NFT collection (even a free one) – do not be lazy and pick it up. In the future, these NFTs could be highly sought after as they will be in high demand due to potential drops. There are also collections with a small supply, the purchase of which on the premarket costs a lot of money (1-2 eth), but they can give a lot of X’s immediately after the start. Such projects are usually either an isolated case of luck or an insight. And you can only get into them using a white list.

Let me give you a few more examples of NFTs from Tier-1/2 projects. I was doing retro activities and using the Orbiter bridge. And it so happened that I got into the distribution of NFTs from the project, which are already trading at $42. And there can be a lot of such examples! The same NFT from ZKSynk, which now costs around $200, and was minted for pennies.

3. Cash flows

Now about one of the most important. How not to confuse financial flows with each other and maintain the overall balance of portfolios in crypto.

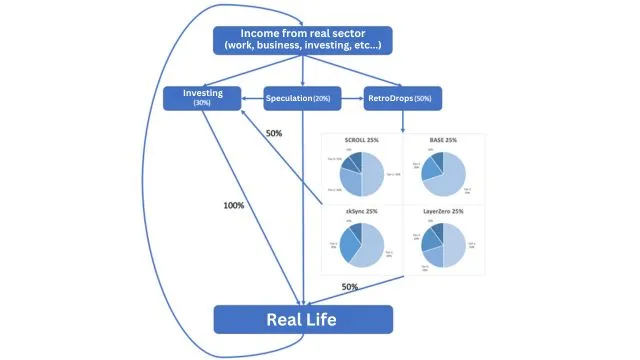

- Investment comes first. This is the most secure of our tools in crypt. The investor’s cash flow cannot be interfered with by others. Money from there can only go outside the crypt.

- Money coming into the crypto from the real sector is distributed in equal shares, thought out in advance. In our example (30, 20 and 50 percent). You need to choose the shares yourself, taking into account your budget and risk tolerance.

- Profits from a speculative portfolio can be distributed anywhere. But most likely you will only lose there. We need it only for peace of mind and to divert our vices (greed and fear) from investment and retro portfolios.

- We bring the profit from retrodrops into the real sector in full or partially redistribute it to the investment portfolio. My personal recommendation is to implement at least 50%.

- You can only load 100% of your income back into crypto if your bank is too small. In all other cases, we take at least half.

4. How to monitor your account farm?

This section will be of interest to those involved in multi-accounting. When you start scaling, after a while it will be almost impossible to answer the question of how much you spent on the farm. The most effective way is to look at the budget allocated for the project and subtract the amount that you have left. But this method will work until the moment you start to have questions like: “Why did I allocate and spend $2000, but it turned out to be not enough?” Also, such a problem may arise if the project requires an excess of resources relative to your expectations. Here the good old accounting of inflows and outflows will come to the rescue. Let’s look at the example of the Scroll project.

Important : you need to be disciplined about accounting, otherwise at some point you will realize that everything is neglected and you will no longer be able to restore the whole picture.

Let’s look at the example of the selected line. To calculate the costs for 1 account, you need to calculate how much money you sent to it, subtract the amount of money returned and separately take into account the current account balance. For example, to run the volumes on the account, I entered 0.4205 eth, scrolled through the volumes and brought 0.4150 eth back to the exchange. That is, during the “circle” the return was 0.0055 eth less. Additionally, I spent 0.0001 eth on exchange withdrawal fees. The full cost of the circle cost me 0.0056 eth. We multiply this amount by the cost of purchasing Ethereum and get a fixed price in usdt – $17.01. A similar section must be created every time you deposit funds into your account. If the money was not withdrawn, then simply leave the withdrawal column empty.

It is also important in your calculations to take into account the price at which you bought Ethereum.

Also, don’t forget to record expenses for paying for proxies, renewing anti-detection browsers, purchasing twitter accounts, discord, telegram etc.

5. What to do if you are already “planted” into one thing?

Immediate answer – Don’t sit down any further! Let’s remember how cash flows are distributed. From the real sector we move money proportionally into 3 portfolios.

- If you have fully invested in one of the three portfolios, then you need to close the “valve” and temporarily stop investing money in this particular portfolio. Usually people plant themselves with retro or speculation. This is an incredibly slippery slope. We remember that these activities are an additional risk within an already risky market. We could lose everything. And in the end, go through a bull run and be left with nothing. It would be stupid and embarrassing, wouldn’t it? Try for a couple of years in the crypt and leave with empty pockets.

- If you don’t have money to invest in crypto , then there’s clearly no point in chasing castles in the air. The most adequate thing you can do is to find a permanent source of income outside the industry. Money makes money. Establish your business, career, and then come back to take risks.

- If you don’t want to pour even more money into crypto , but have invested everything in retro. The most adequate solution would be to start withdrawing some of the funds from there, even though it will be painful and unpleasant.

6. What to do if you have earned a significant amount of money?

I talked to many people who raised very decent capital in crypto, And each of them says one thing: bring at least half of it into real life. Anything can happen tomorrow. The market may collapse, a war may break out, the industry may have legal problems, etc. While this money is not in the real sector, these are just numbers.

Someday the day will come when you will win the big jackpot! At this moment, it is important not to take hasty actions. Take at least a week to understand what is happening and only then think about how to manage your finances. There will be emotions, you may not even notice them. And these emotions can lead to very sad consequences. The only impulsive action you can take is to withdraw this money from the crypto.

7. Bonus

We will look at a cool trading option that works with amazing frequency. Using it on the spot, you can get nice X’s without worrying about your position. I will show you real examples of how this strategy works and how it can be applied in practice. Let me clarify right away that it may take weeks to find such coins, but it’s worth it .

Accumulation is a process in the market when a large player gains a position and drives the price of an asset into a flat (sideways movement), where his orders are executed (buy). Accumulation often works on the principle of a spring; the longer an asset is in this phase, the stronger the movement will be to unload Kitami’s assets.

We, as fish in this crypto ocean, cannot influence this, but we can have a good ride on the green wave of the market.

Let’s look at the main accumulation criteria :-

- Clear support and resistance zones

- Quite long periods of flat

- Trading volumes do not fall to critically low values, but remain at an average or high level.

Using the example of the Shiba coin, we see all these criteria at work: zones, a period of 138 days and average volumes. As a result, we left the accumulation zone by more than 800%.

How to act in such cases ?

- Buy in the support zone.

- Buy in the breakout area with stops (if volumes begin to work out)

- And of course, the basic rules are diversification of assets, exiting a position in parts, not jumping into a project if it has already begun its “native”.

In the second example, the Jasmy project, which has a similar scenario. The same zones, the same long accumulation time (500+ days) and, as a result, exit from the accumulation zone. But there is still quite a lot of growth potential!

The following example may have confused you, but in the end the work started and was quite successful. The Metis coin also met all the criteria and was also accumulated for almost 600 days. It had an aggressive withdrawal of liquidity below the support zone. But the price still returned to the accumulation zone and began its journey from $10-16 to $120.

And finally, a bonus example of the KP3R coin, which is in accumulation right now and has the same mining potential as all previous examples.

–X– –X–

Thanks For it

wellcome!

Thanks for Dose of knowledge!

Wellcome

Can you more tell about Support zone?

Sure, in upcoming articles , just stay tuned